Every evening, as the dinner rush began, the front counter turned into a battlefield of numbers.

Waiters huddled around broken calculators. Conversion rates were scribbled on scraps of paper. Bills were re-priced mid-service as the USD–ZiG exchange fluctuated.

Mistakes slipped through: misconverted bills, short-changed guests, and hours wasted reconciling receipts. The heat from the kitchen only matched the pressure on the floor.

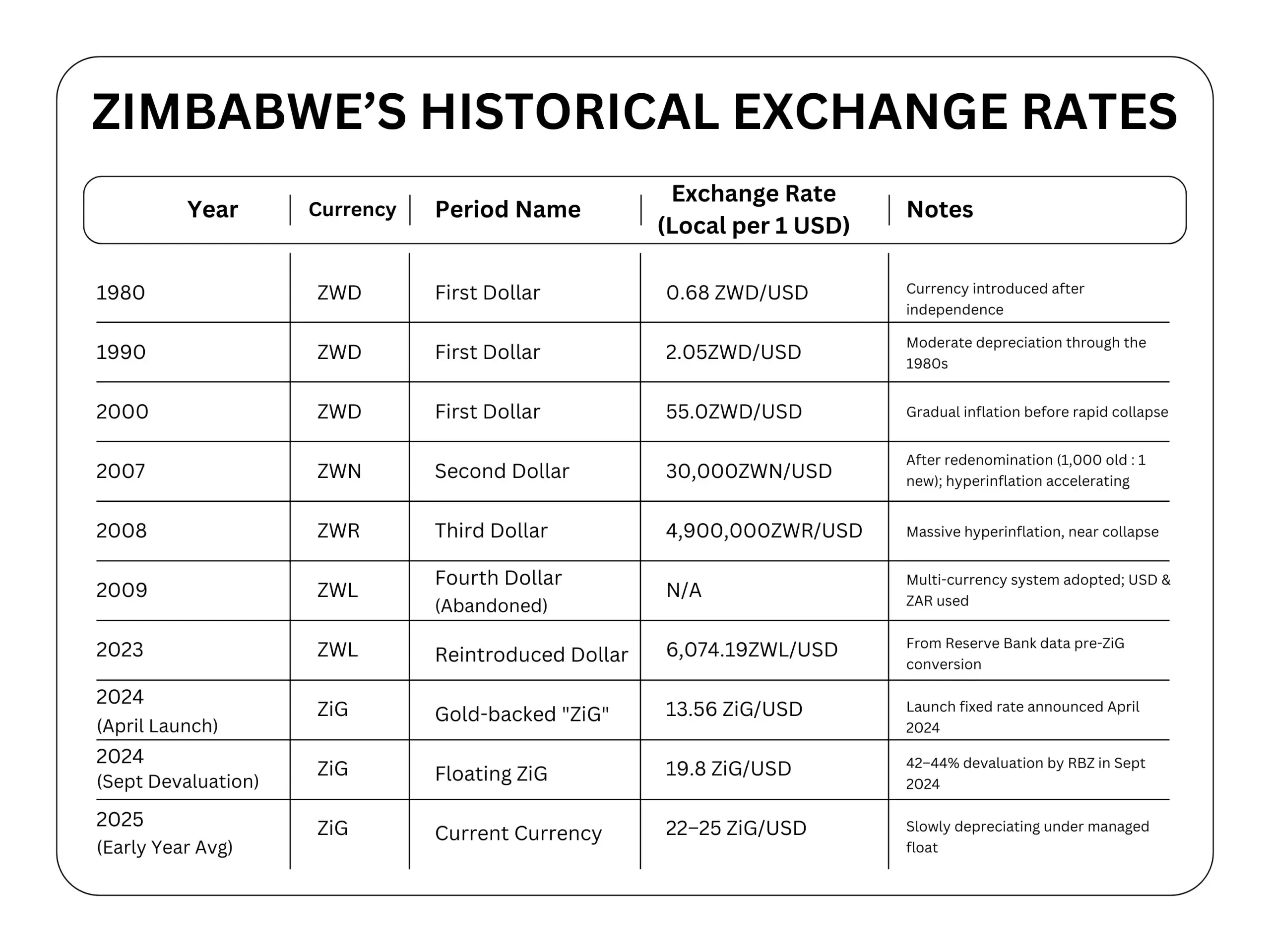

In Zimbabwe — where both US dollars and the new Zimbabwe Gold (ZiG) circulate — running a restaurant isn’t just about food and service. It’s about surviving financial chaos.

For one mid-sized restaurant in Harare, this chaos was quietly draining time, eroding profits, and straining customer trust. That was until SalesPlay POS turned confusion into control.

this family-run, full-service restaurant has become a local favorite for both Zimbabweans and international travelers.

Concept: A warm, art-filled space serving local classics and continental dishes.

Audience: Families, professionals, and tourists seeking authentic flavor with modern comfort.

Team: A husband-and-wife duo — she leads the kitchen; he manages finance and service.

What started as a 20-seat eatery grew into a bustling 50-seat restaurant hosting weekend events. Yet, behind the calm, polished experience lay an outdated system of handwritten receipts, slow spreadsheets, and daily confusion over dual-currency billing.

Scaling felt impossible. The founders dreamed of a second branch — but with no unified data or reliable POS, expansion was out of reach.

They decided to stay anonymous for this story — because, as they put it:

“What matters isn’t our name. It’s how we finally regained control of our business.”

Zimbabwe’s multi-currency system forced staff to handle both USD and ZiG daily. The old billing system only supported one currency, so servers manually recalculated rates for each transaction. A wrong decimal or an outdated rate led to losses or overcharges.

Rates changed almost hourly. The owner constantly had to adjust prices in the back office — often forgetting, especially during rush hours. That inconsistency led to billing errors, refund disputes, and growing customer frustration.

A typical night might unfold like this: the restaurant is full, orders flood in, and the manager realizes the USD-to-ZiG rate just shifted. The cashier must quickly adjust, re-calculate totals, and ensure change is accurate. In the pressure, a few orders slip through with wrong totals or missing conversion tags. The kitchen wonders why a dish was canceled, servers field complaints, and the finance team gets a mess when reconciling.

The impact was more than inconvenience — it was damage to trust. Some guests would complain, “Why are we paying more than earlier guests for the same dish?” Others would demand their previous conversion rates honored. On busy nights, the reconciliation would take hours, delaying closing, and sometimes staff would go home late.

Without real-time inventory tracking integrated into POS, the team had no clear visibility of stock levels across ingredients. A miscounted flour or oil stock untimely caused urgent purchases at inflated prices. They often ran out of key items during peak service, forcing menu modifications or disallowed dishes — disappointing customers.

Multiple spreadsheets, manual transfers, and ad-hoc adjustments made inventory accuracy a nightmare. This disconnect between front-of-house sales and back-of-house stocks led to overstocking some items and under-ordering others, squeezing working capital.

The owners wanted to open a second branch in another part of Harare. But with their current piecemeal, spreadsheet-driven system, they could barely keep one outlet consistent. Multi-store inventory synchronization, consolidated reporting, and staff oversight across branches seemed like a dream.

In short, the restaurant was stuck in a reactive, error-prone, slow cycle — under pressure from currency volatility, operational friction, and compliance risk.

They first heard about SalesPlay POS through a Zimbabwe-based business tech blog highlighting how local retailers overcame currency complexity. Curious, they visited the SalesPlay Zimbabwe page, noting features built for their context: multi-currency support, offline mode, inventory, CRM, and reporting tailored for Zimbabwean needs.

They also discovered the SalesPlay help article explaining how to set alternative currency conversion rates — and recognized that the system already had a built-in mechanism (albeit manual) to support USD/ZiG conversion. Compared to their old system, this was light-years ahead. The owners scheduled a demo with the SalesPlay team, tested a sandbox environment, and felt confident the system understood their local challenges. The decision came quickly: they would migrate to SalesPlay POS.

During implementation week, the SalesPlay onboarding team assigned a local consultant and an online account manager. They mapped the restaurant’s menu, pricing tiers, modifiers, and built an initial inventory catalog. The team configured USD and ZiG as accepted currencies, using the “Alternative Currency” setting in SalesPlay’s Back Office and activating it.

In just three days, the system was live. The first night, the cashier experienced the difference: at checkout, the payment screen showed a dropdown for the currency (USD or ZiG), based on the updated conversion rate. The conversion applied automatically. SalesPlay’s offline mode meant if the internet dropped mid-service, sales continued uninterrupted — later syncing with the backend.

The staff underwent a brief 2-hour hands-on training session on tablet interfaces, currency switching, and order adjustments. Even the older staff found the system intuitive the familiar layout and minimal extra steps made adoption smooth.

Within hours, the owner could open the Back Office portal remotely and see real-time sales, location-wise performance, and inventory consumption. The first week included a few tweaks (menu reordering, rounding rules), but after that, the system ran reliably with minimal adjustments.

Now, when a guest orders, the POS shows menu prices in their preferred currency (USD or ZiG). At checkout, the cashier picks the currency and the system uses the most recent conversion rate entered via Back Office. The math, discount application, and change are all handled automatically. No manual conversion or second-guessing. This eliminated the major friction point that had plagued the restaurant.

Every dish sold instantly decrements its ingredients in the inventory ledger. The chef and manager can see stock levels live, monitor waste, and get alerts when items dip below thresholds. The POS automatically flags low-stock items, prompting menu changes or restock. No more running out of key ingredients mid-service or over-ordering perishable goods.

The owner now logs into the dashboard daily. He can see each shift’s sales, top-selling dishes, payment splits between USD/ZiG, and variations by server. If one server’s conversion errors deviate, the manager can drill into the data and address training gaps.

Because all POS actions carry timestamps and user IDs, internal accountability improved. Discrepancies that once required manual spreadsheets now show up in clear reports.

When planning for branch #2, the system was ready. The owner simply created the new outlet in the Back Office; the menu and pricing synced. Inventory transfers between branches can be scheduled, and consolidated reporting across locations appears in unified dashboards. This multi-store capability is part of SalesPlay’s design.

One evening, the internet connection dropped mid-service. Under the legacy system, sales would’ve stalled or forced manual workarounds. With SalesPlay’s offline mode, staff continued processing orders — everything queued and synced when connectivity returned. The guests never knew; the service was uninterrupted.

Because every transaction is recorded in the actual currency used, the team can now generate ZIMRA-ready reports. They can segment USD-denominated sales, ZiG sales, and show precise conversions. The manual reconciliation burden shrank. No longer do they juggle sheets and notes to adjust for exchange gains/losses.

In audits, they now confidently show receipts with conversion breakdowns, eliminating risk of penalty. The transparency and traceability were major relief.

What once took 2–3 hours nightly of reconciliation now requires just 20–30 minutes. The staff no longer dreads closing. Billing errors due to stale conversion rates dropped by over 80% in the first month. Inventory miscounts, which used to be common, now occur rarely. The kitchen gets accurate ingredient usage data, reducing waste and unplanned shopping sprees.

With accurate conversion and quicker billing flows, average daily throughput increased by 15%. More guests were processed without bottlenecks at checkout. The elimination of unnoticed conversion losses preserved margins. In the first quarter post-implementation, net revenue rose by 12% compared to the same quarter previous year (adjusted for seasonality).

Customers appreciated transparent pricing. Some foreign clients would ask: “Am I being charged the same USD rate as earlier?” The POS interface printed receipts showing original and converted amounts, which built trust. Complaints about overcharges vanished. Servers felt more confident handling payment queries.

When the owner opened the second outlet three months later, the process was seamless. The same menu, same price logic, real-time inventory synchronization, and centralized reporting all just worked. The new branch reached break-even in its second month — partly because operations were already lean and well monitored.

“We used to dread billing every night — manual conversions, arguing with guests, juggling sheets. Now, SalesPlay POS handles the complexity for us. We finally feel control over our currency exposure, inventory, and staff. It’s given us breathing room to focus on food and service, not accounting nightmares.”

The emotional shift is palpable: staff report less stress, the managers leave work earlier, and the founders now feel capable of expansion without fear.

Going forward, the restaurant plans to add a third branch in Harare’s suburbs. They intend to roll out customer loyalty and CRM modules to deepen guest relationships. Online ordering and delivery integration is next. They also anticipate extending support for additional currencies (Euro, Pound) if tourism rebounds.

Standardize your currency workflow. Manually Calculating juggling exchange rates invites errors, delays, and losses.

Adopt POS tools built for your local context. In Zimbabwe, multi-currency, offline mode, and compliance support matter more than generic features.

Discipline + system = stability. The team’s hourly rate-update protocol combined with SalesPlay’s architecture minimized revenue bleed.

Make data visible and useful. Real-time inventory, staff performance, conversion split these unlock smarter decisions, not just raw numbers, alert the low stock.

Invest in scalability early. With the right POS backbone, adding branches, syncing operations, and expanding is achievable without chaos.

Q1: How did SalesPlay help a Zimbabwe restaurant manage dual-currency billing?

SalesPlay’s built-in multi-currency (Alternative Currency) feature allows businesses to accept payments in USD, ZiG or other currencies. By manually updating conversion rates in the Back Office and activating them, the POS can convert totals automatically at checkout eliminating manual conversion errors and streamlining transactions.

Q2: What makes SalesPlay a better POS solution for small restaurants facing currency volatility?

Because SalesPlay is tailored for Zimbabwe, it offers multi-currency support, offline mode (so sales continue without internet), integrated inventory, reporting, and staff oversight — enabling restaurants to survive and thrive in fluctuating currency environments.

Q3: Can SalesPlay handle multi-location restaurant management in Zimbabwe?

Yes. SalesPlay supports multi-store operations, allowing centralized control over menus, inventory synchronization, staff oversight, and consolidated reporting across branches. Expansion becomes scalable with the same backend.

If you’re running a restaurant (or any retail/service business) in Zimbabwe and you’re wrestling with USD-ZiG conversions, billing errors, inventory mismatches, or branch scaling challenges you’re not alone. You deserve a POS that understands your environment.

Start your free trial with SalesPlay POS today and experience firsthand how your transactions, staff, and margins can finally breathe easy. Let SalesPlay take care of the complexity so you can get back to serving unforgettable meals and growing your brand.