The Zimbabwe Revenue Authority (ZIMRA) is the government agency responsible for collecting taxes, enforcing fiscal laws, and ensuring businesses follow proper VAT regulations. ZIMRA manages customs duties, income tax, corporate tax, and VAT and oversees the national fiscalisation program that requires businesses to use approved fiscal devices and POS systems.

In 2025, ZIMRA plays a critical role in:

Ensuring accurate VAT reporting

Reducing tax evasion through digital tracking

Implementing fiscalisation across industries

Approving and regulating fiscal devices

Conducting compliance audits

Protecting consumers through verified fiscal receipts

ZIMRA’s goal is to create a transparent, digital-first tax environment. This is why modern systems like SalesPlay POS, which support fiscalisation, are now essential for Zimbabwean businesses.

Tax compliance in Zimbabwe has changed dramatically.

ZIMRA is increasing digital enforcement, fiscalisation checks are now more frequent, and businesses using outdated POS systems are facing penalties.

Because of this, thousands of retailers, restaurants, pharmacies, and hardware shops are switching to modern cloud POS solutions like SalesPlay POS to avoid errors - and stay 100% compliant.

Zimbabwe’s tax system continues to shift toward full digitalisation. As part of this transformation, ZIMRA requires all VAT-registered businesses to use fiscalised POS systems that can send encrypted sales data automatically to the authority.

In 2025, ZIMRA strengthened its enforcement rules:

More routine compliance audits

Mandatory VAT reporting for both USD and ZiG sales

Stricter validation of fiscal receipts

Increased penalties for businesses without compliant POS setups

However, modern POS platforms - especially SalesPlay POS, which is designed for global fiscalisation - make compliance simple. SalesPlay pos streamlines reporting, automates tax calculations, supports fiscal printers, and ensures every receipt meets ZIMRA’s standards.

This guide walks you step-by-step through everything Zimbabwean businesses need: rules, requirements, integration process, device compatibility, and how to implement SalesPlay POS for fast and error-free compliance.

ZIMRA POS integration is the process of connecting your business’s POS system to a ZIMRA-approved fiscal device, which:

Receives each sale automatically

Applies digital encryption

Generates a fiscal signature

Sends the data to ZIMRA servers

Prints a compliant receipt

SalesPlay POS supports this full workflow, ensuring correct VAT calculation and seamless tax reporting.

The fiscalisation mandate exists to:

Prevent tax evasion

Standardise VAT reporting across Zimbabwe

Create transparent, real-time audit trails

Protect consumers with verified receipts

Reduce manual paperwork and fraud

Any business issuing tax invoices must be fiscalised, including:

Retail shops

Supermarkets

Restaurants, cafés, fast-food outlets

Hardware & building supply stores

Pharmacies

Clothing & electronics stores

Fuel stations

Wholesalers

SalesPlay POS supports all these sectors with multi-store, multi-terminal, and multi-location functionality - ideal for SMEs and high-volume operations.

To stay compliant, businesses must use:

Certified fiscal devices

Daily Z-Reports submitted to ZIMRA

Correct VAT calculation for USD + ZiG

Digital storage of audit-proof records

A POS system capable of fiscalisation

Failing to comply results in:

Heavy fines

Business closure

Loss of tax clearance (ITF263)

Failed audits

Damage to business reputation

Using a ZIMRA-ready POS like SalesPlay POS eliminates all these risks.

Sale is recorded in SalesPlay POS

Transaction is sent to the fiscal device

Device encrypts and digitally signs the sale

Sales data transmitted to ZIMRA

ZIMRA validates and logs the data

Fiscal receipt printed (with signature / QR)

SalesPlay POS dashboard updates instantly

SalesPlay POS automatically applies the data format required by Zimbabwean fiscal devices.

Businesses can use:

Fiscal printers

Fiscalised POS terminals

Electronic Signature Devices (ESDs)

Cloud-based fiscalisation (2025 pilot phase)

SalesPlay POS seamlessly connects to most fiscal printers used in Zimbabwe, ensuring:

Smooth configuration

Fast receipt printing

Accurate tax mapping

Stable data transmission

Ensure your business is VAT-registered and listed under the correct category.

SalesPlay POS offers:

Multi-currency support (USD + ZiG)

Offline + online hybrid mode

Works for retail, restaurants, pharmacies & more

Easy product/price setup

Full compatibility with fiscal printers

Instant reports & analytics

Affordable Android setup

Free plan available for small businesses

Pair the POS with:

Fiscal printer (via USB, LAN, Bluetooth)

Or fiscal module

Map VAT categories

Test sample receipts

SalesPlay POS simplifies the process by:

Automatically formatting fiscal data logs

Reducing manual steps

Minimizing setup errors

Your local ZIMRA office checks:

Receipt format

Fiscal signature

Correct VAT calculation

Device connectivity

Daily Z-reports

Automatic syncing

Cloud backups

Multi-branch visibility

Secure audit records

Integrating your POS system with ZIMRA brings immediate efficiency and compliance advantages. SalesPlay POS amplifies these benefits with automation, cloud syncing, and dual-currency support — giving Zimbabwean businesses a smoother, safer, and more transparent tax process. Below are the key benefits every business gains through proper ZIMRA integration.

Here are short descriptions for each benefit:

SalesPlay eliminates manual books and handwritten invoices by digitizing all transactions automatically.

VAT is calculated instantly and accurately for USD and ZiG, reducing human error and failed audits.

With structured digital records, ZIMRA audits become quicker and more efficient.

Every sale is tracked and stored, ensuring no gaps in fiscal reporting.

SalesPlay’s cloud dashboard gives owners instant visibility of sales across all branches.

Accurate reporting and correct fiscal receipts help businesses avoid costly ZIMRA fines.

Digital audit trails ensure all transaction data is clean, accessible, and compliant.

Offline mode (critical during load-shedding or network drops)

Dual currency (USD + ZiG)

Multi-branch reporting

Cloud dashboard available anywhere

Works on affordable Android devices

Free plan for startups

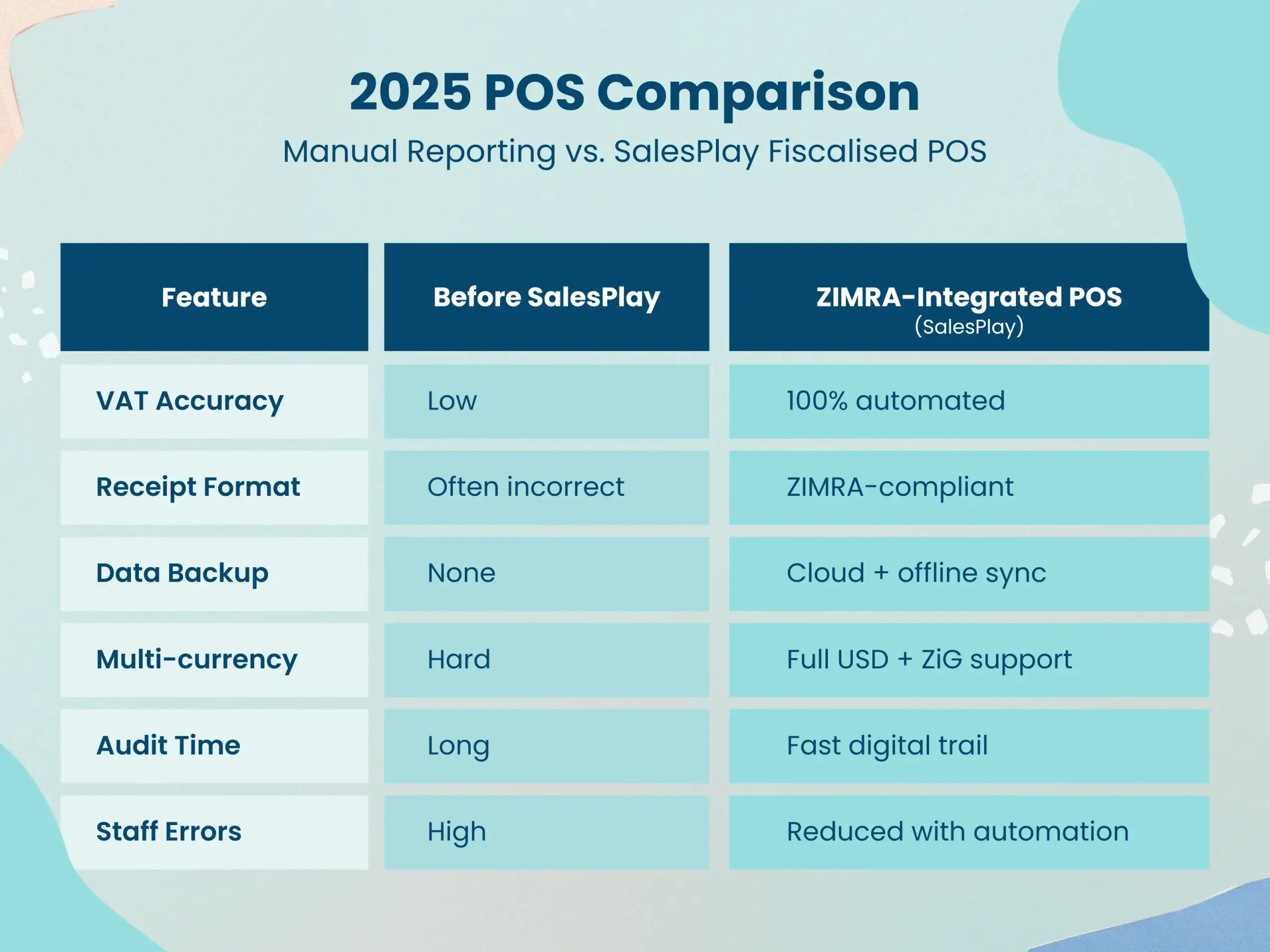

Many Zimbabwean businesses still rely on handwritten invoices and manual VAT calculations, which slow down operations and increase the risk of costly ZIMRA penalties. SalesPlay POS removes these challenges with automated VAT, ZIMRA-compliant receipts, cloud backups, and full USD + ZiG support. The table below shows how SalesPlay POS delivers faster, error-free, and fully compliant billing compared to outdated manual methods.

Zimbabwean businesses often face practical issues when trying to stay compliant from network outages to staff mistakes and multi-branch management. SalesPlay POS is built to solve these everyday challenges with smart automation, offline capability, and ZIMRA-ready features. The table below shows how SalesPlay POS removes the most common pain points and keeps your operations running smoothly.

SalesPlay POS is considered one of the strongest POS choices in Zimbabwe because:

Built for fiscalisation

Supports all major fiscal printers

ZiG + USD dual-currency support

Works across industries

Offers inventory, CRM, POS, and reporting in one

Affordable for SMEs

Quick setup (same-day activation)

Local support availability

Ensure your fiscal printer or ESD always runs the latest firmware. Updates improve stability, fix errors, and maintain full ZIMRA compliance.

Accurate VAT mapping in SalesPlay POSensures every item is taxed correctly in USD and ZiG, reducing audit risks and preventing miscalculations.

Use SalesPlay’s daily Z-reports and summary dashboards to verify sales, VAT amounts, and fiscal data before closing the day.

Proper training reduces mistakes. SalesPlay’s built-in tutorials help staff understand billing, discounts, VAT, and fiscal receipt handling.

Always issue ZIMRA-approved receipts generated by SalesPlay POS. Consistent formatting helps with faster audits and customer verification.

Enable cloud sync so every sale is securely backed up. This protects your records during outages and ensures audit-ready digital storage.

Your business must be officially VAT-registered with ZIMRA before fiscalisation can begin. This ensures correct tax identification and reporting.

Use only approved fiscal printers or ESDs. These devices securely encrypt sales and transmit them to ZIMRA for validation.

A compliant POS such as SalesPlay ensures accurate VAT calculations, dual-currency support (USD + ZiG), and seamless integration with fiscal devices.

Make sure your products and services are mapped to the right VAT rates. SalesPlay lets you configure VAT groups to avoid misreporting.

Your receipt must follow ZIMRA’s standard layout, including fiscal signatures/QR codes. SalesPlay auto-generates ZIMRA-compliant receipts.

Daily fiscal Z-reports are mandatory. They summarize all transactions and must be available for audits. SalesPlay automates daily report generation.

ZIMRA requires accurate, retrievable sales records. SalesPlay provides secure cloud backups plus offline sync for full audit readiness.

Yes. SalesPlay POS supports ZIMRA fiscalisation workflows and integrates with ZIMRA-approved fiscal printers.

Yes- via USB, LAN, or Bluetooth depending on the device.

Yes, SalesPlay POS supports USD + ZiG with correct VAT mapping.

Most businesses are operational within 1–2 days after device pairing.

Yes- SalesPlay POS includes restaurant tables, KDS, modifiers, and kitchen printing.

Yes - offline mode ensures smooth operations even during network outages.

No, but cloud-based systems like SalesPlay POS provide better audit trails and safer backups.

VAT certificate, fiscal device, and a ZIMRA-ready POS system.

ZIMRA compliance is no longer optional- it’s essential for survival, smooth audits, and maintaining tax clearance. But compliance doesn't have to be complicated.

SalesPlay POS makes ZIMRA fiscalisation simple, automated, and 100% ready for USD and ZiG reporting.

If you want a modern, affordable POS system built for Zimbabwean businesses:

Fast setup. Offline mode. Multi-currency. Fiscal printer support.